🔥 This offer expires in:

🔥 This offer expires in:

+1 000-000-000

For Everyday Singaporeans Who Trust Banks and CPF to Grow Their Wealth

17 Investment Tips Every Singaporean Must Know to Grow Wealth (Instead of Letting Banks Eat It Away)

Without betting everything on volatile crypto coins, talking to commission-hungry financial advisors, or needing to study the markets for hours each week, this guide is your practical roadmap to smarter investing.

Inside, you’ll learn how to protect and grow your money in a way that actually works in Singapore’s economy—using proven strategies the wealthy already know. With inflation silently eating away at savings (up to $1,300 lost per year on just $100,000 in the bank), and CPF unable to fully support your retirement needs, now is the time to act.

4.8 / 5 based on 248 reviews

This guide completely changed how I think about money. The section on why banks profit while we lose hit hard—especially the stat about banks earning 17%+ returns on our deposits. I now invest through a robo-advisor and track everything using the spreadsheet included in the bonus bundle. I wish they taught this stuff in school.

INTRODUCING THE SMART MONEY PLAYBOOK

67% of 'Savers' Watch Banks & Inflation Erode Their Wealth - Get Ahead Today.

Is Your Bank Really Helping You Grow?

Every year, millions of Singaporeans lose money without even realizing it. You save diligently, trusting that your bank is protecting your future—but with annual inflation averaging 3-4%, and savings accounts offering only 0.05% to 0.5% interest, your money is quietly shrinking.

Over time, this invisible loss eats away at your savings—while banks pocket huge profits from lending out your money at rates up to 10x higher than what you’re offered.

This guide reveals the smarter alternative. Instead of letting inflation eat away at your savings, discover simple strategies that put you in control—without risky crypto bets, sleepless nights watching the stock market, or relying on overcomplicated financial jargon.

You don’t need to be a pro. You just need to understand how the system works—and how to make it work for you.

It’s time to stop letting your money sit idle and start putting it to work. Shift from being a passive saver to an active investor—on your own terms.

Stop the Slow Leak

Every year, inflation silently drains your wealth. While Singapore's core inflation floats between 2.4% and 4.1%, most bank accounts still offer a meagre 0.05% to 0.35% interest. That means your money is shrinking in value—year after year. This guide teaches you 17 ways to plug that leak and start growing your savings with smart, proven investment strategies.

What the Wealthy Do Differently

The top 1% in Singapore don’t park their money in traditional bank accounts. They invest. This PDF shows you exactly how they grow their wealth using methods like ETFs, REITs, and diversified portfolios that return 5-10% annually. You don’t need millions—just a shift in mindset and a willingness to follow the steps.

How Banks Profit Off You

Banks in Singapore lend out your deposits at 5-10% interest while paying you just 0.05%. You’re literally helping them make billions while your own savings lose value to inflation. In this guide, you'll learn how to reverse the roles and make your money work for you instead.

The Lazy Investor's Blueprint

Investing doesn’t have to be scary or time-consuming. With tools like Robo-Advisors, REITs, and ETFs, you can get started in under 5 minutes a week. This guide breaks it down step-by-step so you can grow your wealth even if you’re busy, cautious, or brand new to investing.

MORE THAN JUST A PDF

Knowledge is power. But in today's economy, the right financial knowledge is your superpower.

Right after your purchase, you'll get instant access to download all 17 investment tips and tools—designed specifically for Singaporeans tired of losing money to banks and stagnant CPF returns.

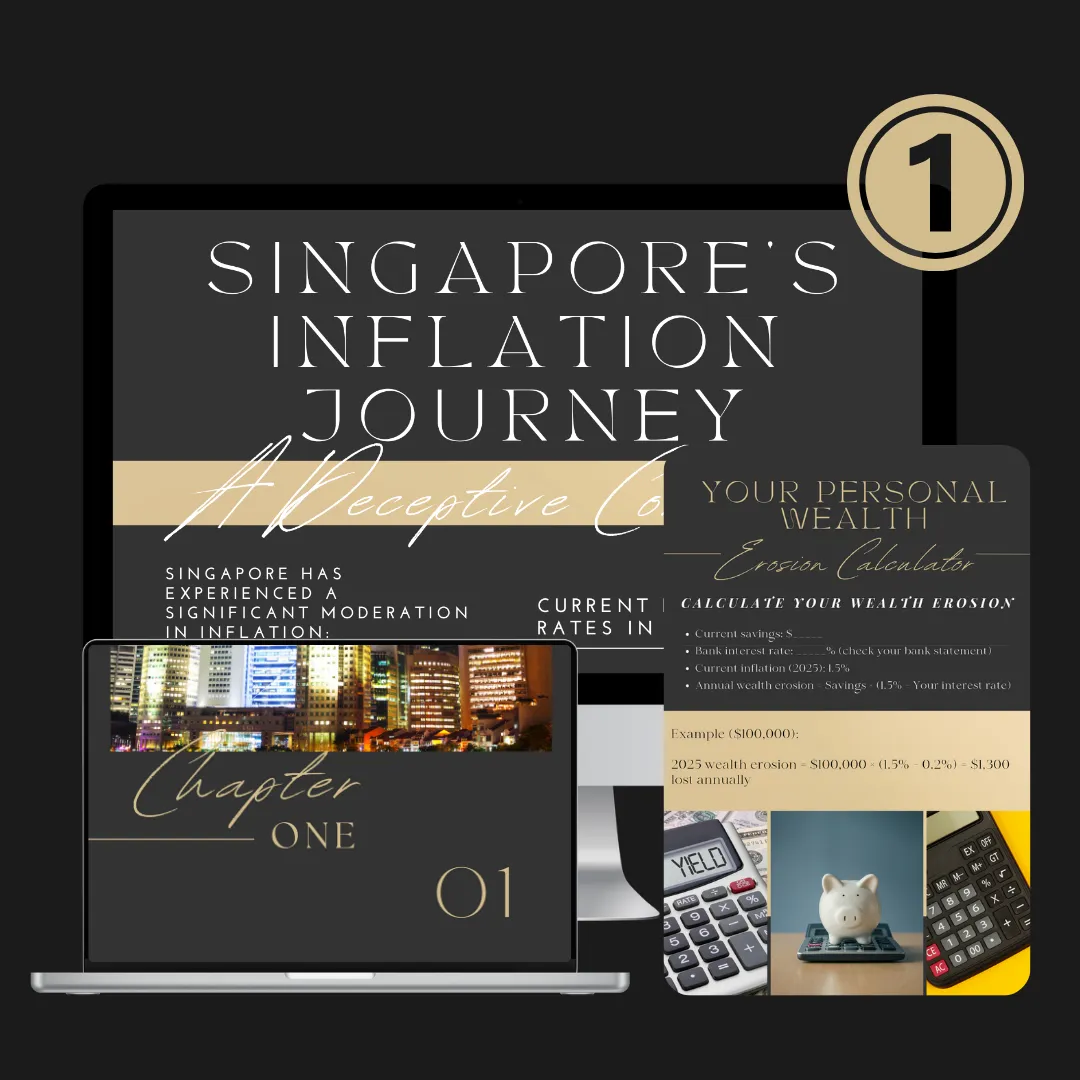

The Truth About Singapore's Banking System

Here's the course content:

Why your bank savings account is a wealth trap

How inflation quietly eats up your money each year

Data-backed breakdown: how $100,000 loses $24,000 in 20 years by just sitting in a bank

The CPF Illusion

Here's the course content:

Why CPF payouts aren't enough for retirement

The growing gap between retirement expenses and CPF LIFE returns

What the wealthy do to supplement CPF that most people don’t

How the Wealthy Actually Grow Their Money

Here's the course content:

The mindset difference between savers and investors

Why investing isn’t risky when done the smart way

How average Singaporeans can build wealth without earning more

Investment Basics for First-Time Investors

Here's the course content:

Breakdown of Singapore-friendly investment tools (ETFs, REITs, bonds)

How to start even with just $100/month

The safest way to begin: index investing and dollar-cost averaging

The Power of Compound Growth

Here's the course content:

Why time matters more than how much you invest

How starting today (even small) can grow into 6-figure portfolios

The shocking loss if you wait 10 years to invest

17 Must-Know Investment Tips For Singaporeans

Here's the course content:

Real, practical advice tailored to your lifestyle

How to beat inflation without high risk

The exact portfolio breakdowns that actually work

STOP LOSING MONEY TO BANKS: GET THE $14,698 INVESTING BLUEPRINT FOR JUST $17

4.8 / 5 based on 248 reviews

Exclusive Bonuses Just For YOU!

When you get the "17 Must-Know Investment Tips for Singaporeans" PDF, you’re not just getting a guide—you’re unlocking a full wealth-building starter kit.

These exclusive bonuses are designed to help you take fast action, avoid common mistakes, and make your money work harder from day one. They complement the PDF to give you even more clarity, confidence, and momentum as you leave old banking habits behind.

BONUS 1: The Inflation Loss Calculator (Value: $49)

Discover exactly how much money you’re losing each year by keeping it in your savings account.

BONUS 2: The CPF Retirement Gap Worksheet (Value: $67)

Based on CPF payout data and Singapore’s rising cost of living, this worksheet helps you calculate how much you actually need for retirement—and where your shortfall lies if you rely on CPF alone.

BONUS 3: The Starter Portfolio Blueprint (Value: $97)

Confused about what to invest in? This plug-and-play investment starter pack gives you 3 proven model portfolios based on your goals and risk level—with clear ETF, REIT, and bond options..

BONUS 4: 30-Day Action Plan (Value: $129)

Stop procrastinating. Follow this week-by-week roadmap to open your investment account, make your first trade, and build momentum with confidence.

BONUS 5: Your Personal Investment Policy Statement (Value: $89)

Used by top investors, this structured template lets you set clear investment goals, rules, and risk parameters—keeping you focused and protecting you from emotional decisions in volatile markets.

BONUS 6: The Ultimate Financial Tracker Google Sheet (Value: $149)

Track every dollar with this all-in-one spreadsheet built for Singaporeans. Manage your monthly expenses, savings, and investment portfolio in one place—automatically.

REAL SUCCESS, REAL PEOPLE

Our Community of Success Stories

"I used to leave all my savings in my bank account thinking it was the safe choice. This guide showed me in real numbers how inflation was silently eating away at it. The IPS template was also surprisingly helpful—I used it to finally set a clear investing plan for myself."

"Most finance stuff feels too advanced or filled with jargon. This was different—it’s written simply, with real stats that apply to Singaporeans. Loved the 17 tips, and the tracker helped me map out exactly how I’m going to get started this month."

"The part about relying too much on CPF really hit me. I didn’t realise how little I’d actually have by retirement. This guide gave me a plan for what to do now—not just later. I’ve already started putting part of my bonus into a REIT ETF thanks to Tip #7."

"I’ve downloaded so many free resources and never took action. This one made me move. The IPS helped me define exactly what I want financially, and I already automated my first investment. The spreadsheet makes it so easy to stay on track."

4.8 / 5 based on 248 reviews

READY TO GET STARTED?

Get The Smart Money Playbook Today!

This isn’t just a PDF—it’s your step-by-step path to building wealth in Singapore without falling for outdated banking advice or blindly trusting CPF. With this bundle, you gain immediate access to proven strategies that show you how to beat inflation, outgrow savings accounts, and invest confidently—even if you're starting from zero.

SMART MONEY PLAYBOOK

$17 SGD

GST Included

4.8 / 5 based on 1,931 reviews

Full 88 Page Smart Money Playbook

BONUS 1: The Inflation Loss Calculator (Value: $49)

Discover exactly how much money you’re losing each year by keeping it in your savings account.

BONUS 2: The CPF Retirement Gap Worksheet (Value: $67)

Based on CPF payout data and Singapore’s rising cost of living, this worksheet helps you calculate how much you actually need for retirement—and where your shortfall lies if you rely on CPF alone.

BONUS 3: The Starter Portfolio Blueprint (Value: $97)

Confused about what to invest in? This plug-and-play investment starter pack gives you 3 proven model portfolios based on your goals and risk level—with clear ETF, REIT, and bond options.

BONUS 4: 30-Day Action Plan (Value: $129)

Stop procrastinating. Follow this week-by-week roadmap to open your investment account, make your first trade, and build momentum with confidence.

BONUS 5: Your Personal Investment Policy Statement (Value: $89)

Used by top investors, this structured template lets you set clear investment goals, rules, and risk parameters—keeping you focused and protecting you from emotional decisions in volatile markets.

BONUS 6: The Ultimate Financial Tracker Google Sheet (Value: $149)

Track every dollar with this all-in-one spreadsheet built for Singaporeans. Manage your monthly expenses, savings, and investment portfolio in one place—automatically.

Still Got Questions?

Here's The Answers

What exactly will this guide teach me?

This guide reveals why most Singaporeans are unknowingly losing money by keeping their savings in traditional bank accounts or relying solely on CPF. You’ll learn 17 beginner-friendly, data-backed investment strategies designed specifically for Singapore’s economic climate—including how to beat inflation, build a diversified portfolio, and grow your money safely over time.

Is this guide suitable for beginners?

Absolutely. This guide is written for anyone who feels stuck, confused, or unconfident when it comes to investing. Whether you're starting with zero knowledge or looking to improve your current financial habits, this guide simplifies complex financial concepts into clear, easy-to-follow steps that anyone can use.

Do I need a large amount of money to start?

Not at all. You can start investing with as little as $50 to $100 per month. In fact, the guide covers low-barrier options like robo-advisors, ETFs, and CPF Investment Scheme opportunities that are ideal for small budgets.

How quickly can I see results?

Some readers report immediate benefits like reducing wealth erosion or cutting hidden banking losses. More substantial wealth-building results take time but can begin compounding within months. The earlier you start, the sooner you stop losing money to inflation.

Will this guide work for me if I’m already investing?

Yes. If you’re already investing, this guide will help you identify blind spots where you may be underperforming. For example, many Singaporeans invest only in local markets and miss out on better returns from diversified global portfolios.

What resources come with the guide?

Along with the main guide, you’ll get a 12-month wealth-building checklist, an expense and investment tracking template, a wealth erosion calculator, retirement planning worksheet, and your investment policy statement—all designed to support you in taking action.

How is this different from free advice I can find online?

Great question! Most free advice is scattered, vague, or focused on foreign markets. This guide is tailored specifically for Singaporeans, using local data (from DBS, MAS, OCBC, etc.) and includes specific CPF and inflation strategies most websites miss. It gives you the "why," "what," and "how" in one place.

Is there a guarantee if I’m not satisfied?

Because this is a digital product, we do not offer refunds. That said, our readers consistently report that the strategies inside helped them avoid costly mistakes and earn back more than the price of the guide within the first 30 days. If you follow the steps, you’ll see the value.

4.8 / 5 based on 248 reviews

All rights reserved The Investment Secrets

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.